Compliance Recap | January 2018

January was a busy month in the employee benefits world. On January 24, 2018, the U.S. Senate confirmed Alex Azar as the new Secretary of the U.S. Department of Health and Human Services (HHS).

The U.S. Department of Labor (DOL) proposed regulations regarding association health plans. HHS released the 2018 federal poverty guidelines. The DOL issued updated civil monetary penalties for 2018 and announced the applicability date for final regulations regarding disability claims procedures. A U.S. District Court modified its order regarding the Equal Employment Opportunity Commission’s wellness regulations.

Congress and the President delayed the Cadillac tax’s effective date, delayed the health insurance tax (HIT), and reauthorized the Children’s Health Insurance Program. The Internal Revenue Service (IRS) released its Employer’s Tax Guide. HHS issued a proposed rule to protect conscience rights in health care and created a new Conscience and Religious Freedom Division within HHS’ Office of Civil Rights.

DOL Issues Proposed Regulations Regarding Association Health Plans

The U.S. Department of Labor’s (DOL) Employee Benefits Security Administration (EBSA) issued a proposed rule which would broaden the definition of “employer” and the provisions under which an employer group or association may be treated as an “employer” sponsor of a single multiple-employer employee welfare benefit plan and group health plan under Title I of the Employee Retirement Income Security Act of 1974 (ERISA).

The DOL posted 79 letters that were submitted as public comments as of January 31, 2018. The deadline for submitting public comments is March 6, 2018.

Read more about the proposed rule.

HHS Releases 2018 Federal Poverty Guidelines

The U.S. Department of Health and Human Services (HHS) released the 2018 federal poverty guidelines (FPL). For a family/household of one in the contiguous United States, the FPL is $12,140. In Alaska, the FPL is $15,180, and in Hawaii, the FPL is $13,960.

For 2018, applicable large employers that wish to use the FPL affordability safe harbor under the employer shared responsibility / play-or-pay rules should ensure that their lowest employee-only premium is equal to or less than $96.72 a month, which is 9.56% of the 2018 FPL.

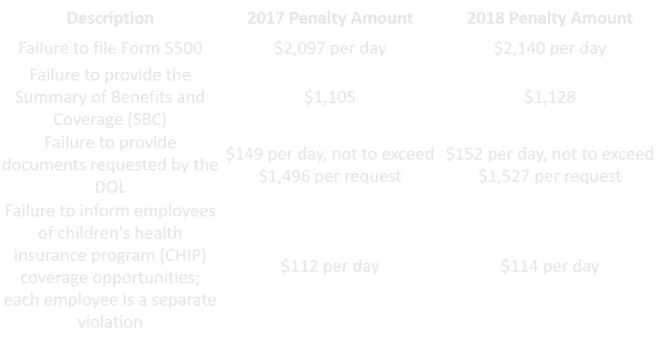

Civil Monetary Penalties Inflation Adjustment for 2018

The U.S. Department of Labor (DOL) published its civil monetary penalties for 2018. Under federal law, the DOL is required to annually adjust its regulations’ civil monetary penalties for inflation no later than January 15 of each year. The adjusted penalty amounts are effective for violations occurring after November 2, 2015, that have penalties assessed after January 2, 2018.

Below are some examples of the increases.

DOL Issues Final Disability Claims Procedures Regulations’ Applicability Date

The U.S. Department of Labor (DOL) announced that April 1, 2018, will be the applicability date for its rule that amends the claims procedure requirements of ERISA-covered employee benefit plans that provide disability benefits. The DOL’s Fact Sheet contains a summary of the regulation’s requirements.

U.S. District Court Modifies Order Regarding EEOC Wellness Rules

In August 2017, the United States District Court for the District of Columbia held that the U.S. Equal Employment Opportunity Commission (EEOC) failed to provide a reasoned explanation for its decision to adopt 30 percent incentive levels for employer-sponsored wellness programs under both the Americans with Disabilities Act (ADA) rules and Genetic Information Nondiscrimination Act (GINA) rules.

In December 2017, the court vacated the EEOC rules under the ADA and GINA effective January 1, 2019, and ordered the EEOC to promulgate any new proposed rules by August 31, 2018.

In January 2018, the EEOC asked the court to reconsider the portion of the court’s order that required the EEOC to promulgate new proposed rules by August 31, 2018. The court vacated that portion of its order. The court’s order to vacate the portions of the EEOC’s wellness rules under the ADA and GINA as of January 1, 2019, remains.

Read more about the court’s order.

Congress Delays Cadillac Tax Effective Date, Delays HIT Tax and Reauthorizes CHIP

Congress and the President passed H.R. 195, a short-term spending bill. The bill delays the effective date of the excise tax on high-cost employer sponsored health coverage (“Cadillac tax”) to 2022. The bill delays the health insurance tax (HIT) that applies to insurers. The HIT was in effect in 2014, 2015, and 2016, and will be in effect for 2018. Now the HIT will be delayed from 2019 to 2020; essentially, the bill implemented a one-year moratorium for the HIT for 2019. The bill also reauthorizes the Children’s Health Insurance Program (CHIP) for six years.

IRS Issues 2018 Employer’s Tax Guide

The Internal Revenue Service (IRS) issued its Publication 15 (Circular E) Employer’s Tax Guide that discusses employers’ tax responsibilities. The guide generally discusses health insurance plans, health savings accounts, and medical care reimbursement.

HHS Issues Proposed Rule to Protect Conscience Rights in Health Care

The U.S. Department of Health and Human Services (HHS) published a proposed rule titled “Protecting Statutory Conscience Rights in Health Care; Delegations of Authority.”

HHS proposes this rule pursuant to President Trump’s May 4, 2017, Executive Order 13798 “Promoting Free Speech and Religious Liberty” and the U.S. Attorney General’s October 6, 2017, “Federal Law Protections for Religious Liberty” memorandum.

HHS proposes this rule to enhance awareness and enforcement of federal health care conscience laws and associated anti-discrimination laws, to further conscience and religious freedom, and to protect the right to abstain from certain activities related to health care services without discrimination or retaliation.

The rule cites several federal health care conscience laws and the activities that they protect, including:

- The Church Amendments: conscience protections related to abortion and sterilization

- The Coats-Snowe Amendment: conscience protections related to abortion, training, and accreditation

- The Weldon Amendment: protections against discrimination for health care entities and individuals who do not further abortion or other services

- HHS’ 2011 final rule that enforces the Church, Coats-Snowe, and Weldon Amendments

- The Consolidated Appropriations Act of 2017: protections from discrimination for health care entities and individuals who object to furthering or participating in abortion under programs funded by HHS’ annual appropriations

- The Patient Protection and Affordable Care Act: conscience protections related to assisted suicide, abortion, and the individual mandate to maintain minimum essential coverage

- The Assisted Suicide Funding Restriction Act of 1997: protections for Medicare or Medicaid program providers and their employees from informing individuals about a right or service related to assisted suicide and from applying any advance directive term related to assisted suicide

- Medicare and Medicaid: protection from being compelled to provide, reimburse for, or cover any counseling or referral service over a moral or religious objection

- Global health program conscience and anti-discrimination protections

- Exemptions from compulsory health care or services generally and under specific programs for hearing screening, occupational illness testing, suicide assessment or treatment services, vaccination, and mental health treatment

- Conscience clauses related to religious nonmedical health care in Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP).

The proposed rule aims to revise the current regulatory framework of federal health care conscience protection statutes to a more robust regulatory framework similar to those that implement and enforce other civil rights laws.

To do so, the proposed rule would require written assurances and certifications of compliance with federal health care conscience and associated anti-discrimination laws as part of accepting federal financial assistance from HHS. The proposed rule would also require HHS and certain recipients to post a notice to the public, patients, and employees of their protections under the federal health care conscience and associated anti-discrimination statutes, including how to file a complaint with HHS’ Office of Civil Rights (OCR). The proposed rule’s Appendix A provides the notice’s text. Further, the proposed rule would require recipients to report information about OCR investigation notices and compliance review letters to their applicable HHS funding source and to disclose complaints filed with OCR when applying for new or renewed federal financial assistance from HHS.

The proposed rule details OCR’s authority to conduct outreach, provide technical assistance, initiate compliance reviews, receive and process complaints, and conduct investigations. The proposed rule grants OCR discretion to choose its means of enforcement, which will range from informal resolution to funding termination. The OCR may also refer cases to the U.S. Department of Justice for enforcement.

Public comments are due by March 27, 2018.

HHS Creates New Conscience and Religious Freedom Division

The U.S. Department of Health and Human Services (HHS) announced the new Conscience and Religious Freedom Division (CRFD) within HHS’s Office of Civil Rights (OCR). According to HHS’ press release, the CRFD will restore federal enforcement of laws that protect the rights of conscience and religious freedom. CFRD’s website includes instructions on how to file a conscience or religious freedom complaint with OCR.

Question of the Month

- Can an employer exclude children from coverage based on a child’s access to other coverage, employment status, or marital status?

- No, if a group health plan provides dependent coverage, then the plan must generally make coverage available for children until age 26. These group health plans must not define dependent, for purposes of dependent coverage, in terms other than the relationship between the child and the plan participant.

This means that a plan cannot use items such as a child’s access to other coverage, employment status, marital status, tax dependent status, residency, or student status to define dependent.

Also, if the employer is an applicable large employer, then it must offer coverage to its full-time employees’ dependent children to avoid penalties under the employer shared responsibility provisions.

2/8/2018