IRS Releases 2025 Benefit Plan Limits

As we approach 2025, it’s essential for employers to stay informed about the updated cost-of-living adjustments (COLAs) that impact employee benefits. Recent IRS updates affect key programs such as flexible spending accounts (FSAs), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs), transportation fringe benefits, adoption assistance, and health savings accounts (HSAs).

Understanding and implementing these changes can help optimize tax advantages, maintain compliance, and support employees in managing their healthcare and other related costs. This Advisor highlights the 2025 limits for these key benefits and provides actionable steps employers should take to ensure proper integration of these changes into their benefits packages.

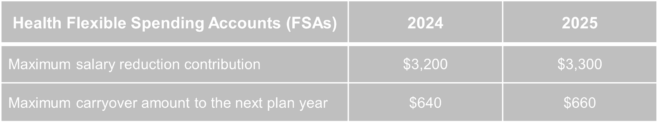

Health FSAs

Health flexible spending accounts (health FSAs) allow employees and employers to contribute pre-tax dollars to an individual account for the employee to use to pay eligible medical expenses. One of the primary features of health FSAs is that funds in the account must be spent on qualifying expenses before the end of the plan year or the balance is forfeited. Employers may allow either a grace period or carryover of a limited amount of unspent funds to the next plan year to help employees avoid forfeiture. The IRS establishes the maximum annual contribution limit to health FSAs and the maximum amount that can be carried over to the next plan year. Employers may choose to provide lower health FSA limits for their benefit program but may not allow contributions more than the maximums.

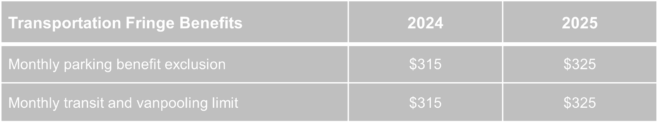

Transportation Fringe Benefits

Employers may offer their employees nontaxable qualified transportation benefits up to the monthly limits.

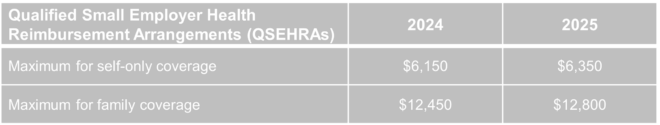

Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs)

Small employers (generally those with 50 employees or less) that don’t offer a group health plan can contribute to their employees’ health care costs on a tax-free basis through QSEHRAs. The employer contribution limits are:

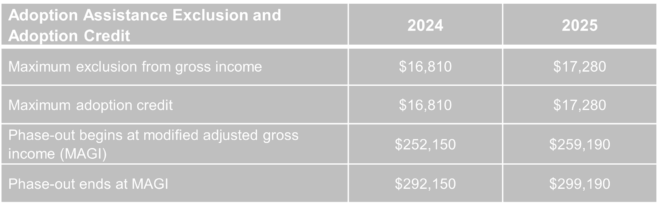

Adoption Assistance Exclusion and Adoption Credit

The adoption tax credit is a tax benefit designed to offset the costs of adopting a child. Employers may exclude payments or reimbursements made under an adoption assistance program for an employee’s qualified adoption expenses within the limits from the employee’s wages subject to federal income tax withholding.

All reimbursements, including those over the exclusion limit, are reported in box 12 of the employee’s W-2.

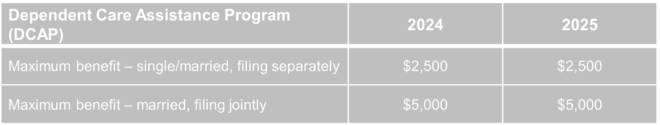

Dependent Care Assistance Program (DCAP)

A DCAP is a type of FSA that allows an employee or the employer to set aside pre-tax dollars to pay for the care of a qualifying dependent. The maximums for DCAP contributions remain the same for 2025.

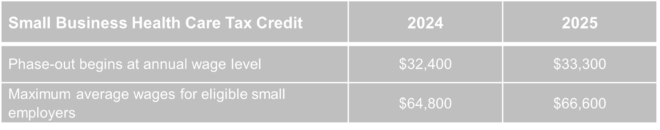

Small Business Health Care Tax Credit

To qualify for the Small Business Health Care Tax Credit, the employer must:

- Have fewer than 25 full-time equivalent (FTE) employees

- Have an average employee salary less than the COLA adjusted wage (see table below)

- Pay at least 50% of full-time employees’ premium costs

- Offer Small Business Health Options Program (SHOP) coverage to all full-time employees

The tax credit can pay up to 50% of the employer portion of employees premiums (35% for non-profits).

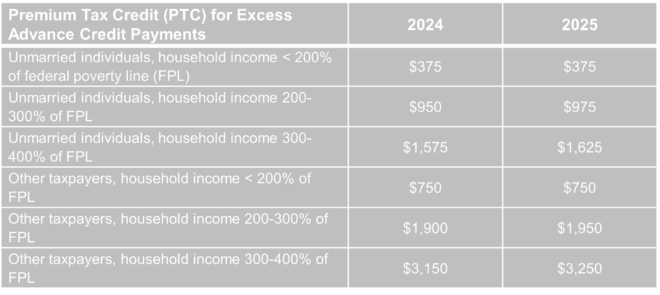

Premium Tax Credit (PTC) for Excess Advance Credit Payments

The PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. Employees receiving PTCs may trigger the IRS to review employer compliance with the Affordable Care Act (ACA) employer mandate.

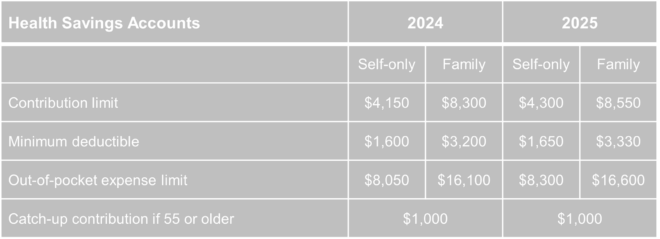

Health Savings Accounts (HSAs)

Employees and their employers may contribute up to the annual maximum for HSAs if the employee and any included family members are covered by a qualified high deductible health plan (HDHP).

Employer Action Items

- Review and update benefits materials: Ensure all documents, including cafeteria plans, reflect the 2025 limits for FSAs, transportation fringe benefits, QSEHRAs, and other programs.

- Ensure compliance: Evaluate plan affordability and ACA compliance in light of the updated thresholds.

- Coordinate with payroll and benefits providers: Collaborate with external payroll and benefits vendors to update payroll systems, ensuring seamless compliance with the new caps on contributions and reimbursements.

- Communicate changes during open enrollment: Use the upcoming open enrollment period to educate employees on the new 2025 limits, highlighting how these changes may impact their benefits selections and tax savings for the year.

- Inform HR teams: Ensure that HR staff is aware of the new limits and prepared to answer employee questions and properly administer benefits under the new guidelines.