IRS Releases Draft Forms and Instructions for 2018 ACA Reporting

Background

Background

Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance while applicable large employers (ALEs) are required to offer health benefits to their full‑time employees.

Reporting is required by employers with 50 or more full-time (or full-time equivalent) employees, insurers, or sponsors of self-funded health plans, on health coverage that is offered in order for the Internal Revenue Service (IRS) to verify that:

- Individuals have the required minimum essential coverage,

- Individuals who request premium tax credits are entitled to them, and

- ALEs are meeting their shared responsibility (play or pay) obligations.

2018 Draft Forms and Instructions

The IRS recently released draft instructions for both the 1094-B and 1095-B and the 1094-C and 1095-C and the draft forms for 1094-B, 1095-B, 1094-C, and 1095-C. There are no substantive changes in the forms or instructions between 2017 and 2018, beyond the further removal of now-expired forms of transition relief. There is a minor formatting change to draft Form 1095-C for 2018. There are dividers for the entry of an individual’s first name, middle name, and last name.

In past years, the IRS provided relief to employers who made a good faith effort to comply with the information reporting requirements and determined that they would not be subject to penalties for failure to correctly or completely file. This did not apply to employers that failed to timely file or furnish a statement.

For 2018, the IRS has stated that it does not anticipate extending the “good faith compliance efforts” relief relating to reporting requirements. Employers should be ready to fully meet the reporting requirements in early 2019 with a high degree of accuracy. There is, however, relief for de minimis errors on Line 15 of the 1095-C.

The IRS confirmed there is no code for Form 1095-C, Line 16 to indicate an individual waived an offer of coverage. The IRS also kept the “plan start month” box as an optional item for 2018 reporting.

Employers must remember to provide all printed forms in landscape format, not portrait.

When? Which Employers?

Reporting will be due early in 2019, based on coverage in 2018.

For the calendar year 2018, Forms 1094-C, 1095-C, 1094-B, and 1095-B must be filed by February 28, 2019, or April 1, 2019, if filing electronically. Statements to employees must be furnished by January 31, 2019. In January 2018, the IRS extended the due date for furnishing the 2017 statements to employees from January 31, 2018, to March 2, 2018. The IRS has stated that it does not anticipate extending the January 31, 2019, due date of statements furnished to employees for 2018.

All reporting will be for the 2018 calendar year, even for non-calendar year plans. The reporting requirements are in Sections 6055 and 6056 of the ACA.

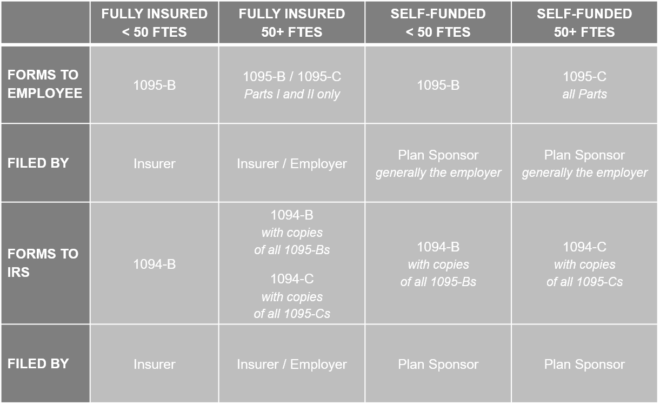

The major reporting requirements are:

Penalties for Failure to File

- The penalty for failure to file a correct information return is $270 for each return for which the failure occurs, with the total penalty for a calendar year not to exceed $3,275,500.

- The penalty for failure to provide a correct payee statement is $270 for each statement for which the failure occurs, with the total penalty for a calendar year not to exceed $3,275,500.

Special rules apply that increase the per-statement and total penalties if there is an intentional disregard of the requirement to file the returns and furnish the required statements.

6055 Requirements: Forms 1094-B and 1095-B

IRS Form 1095-B is used to meet the Section 6055 reporting requirement. Section 6055 reporting relates to having coverage to meet the individual shared responsibility requirement. Form 1095-B is used by insurers, plan sponsors of self-funded multiemployer plans, and plan sponsors of self-funded plans that have fewer than 50 employees to report on coverage that was actually in effect for the employee, union member, retiree or COBRA participant, and their covered dependents, on a month-by-month basis. Filers use Form 1094-B as the transmittal to submit the 1095-B return.

6056 Requirements: Forms 1094-C and 1095-C

IRS Form 1095-C is primarily used to meet the Section 6056 reporting requirement. The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement. Information from Form 1095-C is also used to determine whether an individual is eligible for a premium tax credit.

Employers with 50 or more full-time or full-time equivalent employees complete much of Form 1095-C to report on coverage that was offered to the employee and eligible dependents. In addition, to save large employers that sponsor self-funded plans from having to complete two forms, Part III has been included in Form 1095-C. Large employers with self-funded plans use that part of the form to report information about actual coverage that otherwise would be reported on Form 1095-B. Employers with 50 or more full-time or full-time equivalent employees with fully insured plans will skip section III, and their carrier will complete a separate B series form to report that information for them.

Form 1094-C is used in combination with Form 1095-C to determine employer shared responsibility penalties.

Employers with 50 or more full-time or full-time equivalent employees must provide Form 1095-C to virtually all employees who were full time (averaged 30 hours per week) during any month during the year, even if coverage was not offered to the employee or the employee declined coverage. (If the full-time employee never became eligible during the year, most likely because the employee is a variable-hours employee in an initial measurement period, the form does not need to be provided).

2018 Plan Start Month Box

The 1095-C form retains the “plan start month” box, which was optional for 2015, 2016, and 2017; the box remains optional for 2018. This box is intended to provide the IRS with information used to calculate an individual’s eligibility for premium tax credits, which is based on the employer plan’s affordability, calculated by plan year. In 2017 the IRS had indicated the box may be mandatory in 2018.

2018 De Minimis Errors on 1095-C, Line 15

Form 1095-C, Line 15 is where employers report on the monthly cost of the lowest employee-only premium offered to employees. So long as the dollar amount reported on Line 15 is not incorrect or off by more than $100, no penalty will be imposed for filing incorrect information. However, payees (employees) can elect out of the safe harbor and request a corrected form. If an employee (payee) does that, penalties for the error would apply to the employer. The safe harbor applies to reporting only, not the actual offer of coverage and affordability.

Background

Background