New HDHP Preventive Care Benefits

In response to the President’s Executive Order 13877 “Improving Price and Quality Transparency in American Healthcare to Put Patients First,” the Internal Revenue Service (IRS) released Notice 2019-45 to expand the list of preventive care benefits that a high deductible health plan (HDHP) can provide without a deductible (or with a deductible below the annual minimum deductible) so that a person can maintain health savings account (HSA) eligibility.

As background, to participate in an HSA, an individual must be covered under an HDHP on the first day of the month.

The HDHP must provide “significant benefits.” For example, it cannot exclude in-patient care or hospitalizations, be a fixed indemnity benefit, or only cover certain specified diseases such as cancer.

In 2019, the individual must have an annual deductible of at least $1,350 for self-only coverage ($1,400 for 2020), and the deductible and out-of-pocket expense cannot exceed $6,750 ($6,900 for 2020). These dollar figures change annually. For an individual enrolled in family coverage (or, other than self-only), the deductible must be at least $2,700 in 2019 ($2,800 for 2020), and the deductible and out-of-pocket expenses cannot exceed $13,500 ($13,800 for 2020).

Generally, an HDHP may not provide benefits for any year until the minimum deductible for that year is satisfied. However, there’s a safe harbor that allows an HDHP to have no deductible for preventive care, in part, because the Patient Protection and Affordable Care Act (ACA) requires non-grandfathered group health plans and issuers to provide benefits for certain preventive health services without imposing cost-sharing requirements.

Before July 17, 2019, the definition of preventive care generally did not include any service or benefit intended to treat an existing illness, injury, or condition.

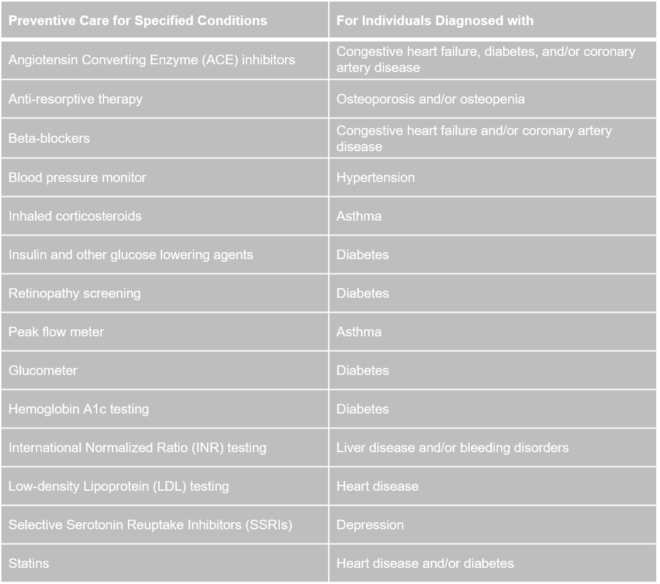

Effective July 17, 2019, the IRS expanded the list of preventive care benefits that an HDHP can provide without a deductible or with a deductible below the annual minimum deductible:

The services and items listed above are treated as preventive care:

- only when prescribed to treat a person diagnosed with the associated chronic condition listed in the table’s second column, and

- only when prescribed for the purpose of preventing the chronic condition’s exacerbation or a secondary condition’s development.

If a person is diagnosed with more than one chronic condition, all listed services and items applicable to the multiple conditions are preventive care.

The IRS intends to review this list every 5 to 10 years to determine whether to add or remove services or items.

Last, although these services and items are preventive care for purposes of Section 223 (regarding HSAs), the IRS does not treat these services and items as preventive care required to be provided without cost sharing under the ACA.

7/18/2019