Frequently Asked Questions about the Patient-Centered Outcomes Research Institute (PCORI) Fee

Updated May 2024

Q1: What plans does the PCORI fee apply to?

A1: All plans that provide medical coverage to employees owe this fee. Medical coverage includes preferred provider (PPO) plans, health maintenance organization (HMO) plans, point-of-service (POS) plans, high deductible health plans (HDHPs), and health reimbursement arrangements (HRAs).

The fee does not apply to:

- Stand-alone dental and vision plans (benefits elected separately from medical, or provided under separate insurance policies from the medical coverage)

- Life insurance

- Short- and long-term disability and accident insurance

- Long-term care

- Health flexible spending accounts (FSAs), as long as the employee also is offered medical coverage, and any employer contribution is (in most cases) $500 or less

- Health savings accounts (HSAs)

- Hospital indemnity or specified illness coverage

- Employee assistance programs (EAPs) and wellness programs that do not provide significant medical care or treatment

- Stop-loss coverage

Q2: Does the fee apply to all medical plans?

A2: Yes, it does. There are no exceptions for small employers. There are no exceptions for government, church, or not-for-profit plans. Grandfathered plans owe this fee. Union plans must pay the fee on their covered members.

Q3: Who must pay this fee?

A3: The fee must be determined and paid by:

- The insurer for fully insured plans (although the fee likely will be passed on to the plan)

- The plan sponsor of self-funded plans, including HRAs

- The plan’s TPA may assist with the calculation, but the plan sponsor must file IRS Form 720 and pay the applicable fee.

- If multiple employers participate in the plan, each must file separately unless the plan document designates one as the plan sponsor.

Q4: When is the PCORI fee due?

A4: The fee is due by July 31 of the year following the calendar year in which the plan/policy year ends.

The fee initially applied from 2012 to 2019, based on plan/policy years ending on or after October 1, 2012, and before October 1, 2019. However, in December 2019, the Further Consolidated Appropriations Act, 2020 extended the fee to plan/policy years ending before October 1, 2029.

Note: No fee is due for plan/policy years before these dates. If a plan/policy year began between October 2, 2012, and October 31, 2012, the first fee was due by July 31, 2013.

Q5: How much is the fee?

A5: The fee is $1.00 per covered life in the first year the fee is in effect. The fee is $2.00 per covered life in the second year. Thereafter, the fee is $2.00, adjusted for medical inflation, per covered life.

For plan years that end on or after October 1, 2022, and before October 1, 2023, the indexed fee is $3.00.

For plan years that end on or after October 1, 2023, and before October 1, 2024, the indexed fee is $3.22.

The fee is based on covered lives (i.e., employees, retirees, and COBRA participants and covered spouses and children). If, however, the plan owes the fee for HRA or health FSA coverage, it only needs to count the employees/retirees/COBRA participants – covered dependents are not counted for HRAs or health FSAs. Employees and their dependents who are residing outside the U.S. (based on the address on file with the employer) may be excluded.

Q6: What if the plan terminates?

A6: The fee is due for each plan year the plan was in effect.

Q7: What if a plan is new?

A7: The fee will be due for each year the plan is in effect. The rate for that plan year will apply.

Q8: How is the fee calculated?

A8: Plan sponsors of self-funded benefits have several options to calculate the fee:

- Actual Count Method – Count the covered lives on each day of the plan year and average the result.

- Snapshot Count Method – Determine the number of covered lives on the same day (plus or minus three days) of each quarter or month and average the result.

Example: Acme has a calendar year plan, so this is its second year for the fee. Acme has chosen to measure on the first calendar day of each quarter. On January 1, 2013, it had 127 covered lives on its plan. On April 1, 2013, it had 130 covered lives. On July 1, 2013, it had 132 covered lives. On October 1, 2013, it had 128 covered lives. Acme will owe $258 on July 31, 2014 (127 + 130 +132 +128 = 517. Dividing by 4 gives an average of 129.25, which will be rounded down to 129 covered lives and multiplied by $2.00.).

Example: Zest has a March 1 plan year, so this is the first year the fee applies. Zest has chosen to measure on the first calendar day of each quarter. On April 1, 2013, it had 46 covered lives on its plan. On July 1, 2013, it had 50 covered lives. On October 1, 2013, it had 52 covered lives. On January 1, 2014, it had 48 covered lives. Acme will owe $49 on July 31, 2014 (46 + 50 + 52 + 48 = 196. Dividing by 4 gives an average of 49 covered lives; that is multiplied by $1.00.).

- Snapshot Factor Method – Determine the number of covered employees/retirees/COBRA participants on the same day (plus or minus three days) of each quarter or month who have self-only coverage and the number who have other than self-only Multiply the number of employees/retirees/COBRA participants with other than self-only coverage by 2.35 to approximate the number of covered dependents (rather than actually counting them) and add that to the number of employees/retirees/COBRA participants with self-only coverage. Average the result.

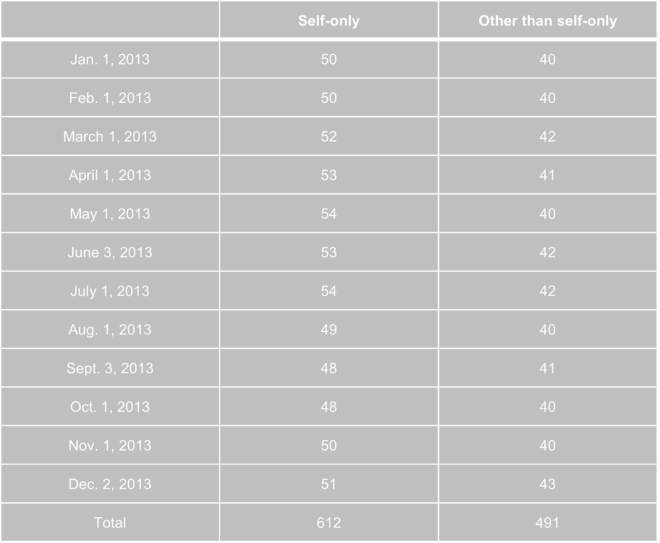

Example: Blackstone has a calendar year plan. Blackstone has chosen to measure on the first workday of each month. Its covered employees are:

For the year, Blackstone has a total of 612 self-only employee lives and 491 other than self-only employee lives. Blackstone will multiply the 491 by an assumed 2.35 dependents per employee, for total of 1,153.85 employee/dependent covered lives. Add 612 and 1,153.85 for a total of 1,765.85 lives which is then divided by 12 for the average number of lives. Blackstone will owe $294 on July 31, 2014 (1,765.85 divided by 12 gives an average of 147.154, which will be rounded down to 147 covered lives and multiplied by $2.00 since this is Blackstone’s second fee year).

- Form 5500 Method – Determine the number of participants at the beginning and end of the plan year as reported on Form 5500.

- If dependents are covered, add the participant count for the start and the end of the plan year.

Example: Smith Bros. has a May 1 plan year. Smith’s plan covers dependents. Smith’s Form 5500 for the plan year May 1, 2012 – April 30, 2013, showed 131 participants at the beginning of the year and 137 participants at the end of the year. Smith will owe $268 on July 31, 2014 (131 + 137 = 268, multiplied by $1.00 since this is Smith’s first fee year).

- If dependents are not covered, add the participant count for the start and the end of the plan year and average the result.

Example: Taylor Trucking has a March 1 plan year. Taylor’s plan does not cover dependents. Taylor’s Form 5500 for the plan year March 1, 2012 – February 28, 2013, showed 450 participants at the beginning of the year and 461 participants at the end of the year. Taylor will owe $456 on July 1, 2014 (450 + 461 = 911. Divide by 2, to get 455.5 and round up. Multiply the result by $1.00 since this is Taylor’s first fee year.).

- Form 5500 must be filed by July 31 to use this option.

- It is unclear how rounding should be handled if the fraction is 5 or higher. Clearly fractions of less than 0.5 can be rounded down.

- For plan years ending on or after October 1, 2019, and before October 1, 2020, plan sponsors may use one of the methods noted above or any reasonable method for calculating the average number of covered lives. If a plan sponsor uses a reasonable method to calculate the average number of covered lives for plan years ending on or after October 1, 2019, and before October 1, 2020, then that reasonable method must be applied consistently for the duration of the plan

Q9: May an employer change its calculation method?

A9: The same method must be used throughout a reporting year, but it may be changed from year to year.

Q10: What if the employer sponsors multiple plans?

A10: If there are multiple self-funded plans (such as self-funded medical and HRA) with the same plan year, only one fee would apply to a covered life.

For example, Z Corp. has a self-funded medical plan and a self-funded HRA that operate on a calendar year basis. The medical plan has 110 covered employees and 205 covered dependents. The same 110 employees are covered by the HRA. Z Corp. will owe $630 on July 31, 2014 [(110 + 205) x $2.00].

If there are both fully insured and self-funded plans, a fee would apply to each plan unless the employee is only covered under one type of plan. The insurer would pay the fee on the insured coverage and the plan sponsor would pay the fee on the HRA.

For example, Jay County has a fully insured medical plan and an integrated self-funded HRA. Both operate on a May 1 plan year. 130 employees and 212 dependents are covered by the medical plan and HRA. The insurer will pay a fee of $342 on the employees and dependents covered under the fully insured medical policy on July 31, 2014. Jay County will pay a fee of $130 on July 31, 2014 (because Jay owes the fee on the employees, but not the dependents, covered under the HRA).

Q11: How is the fee paid?

A11: The fee will be reported and paid on IRS Form 720 each July 31.

- Even though Form 720 is generally filed quarterly, the PCORI report and fee will just be filed once per year, at the end of the second quarter (unless the employer needs to file the form to report another tax).

- Even though government, church, and not-for-profit plans don’t generally file federal tax returns, they are required to file the Form 720.

- Only the relevant parts of the form needs to be The relevant parts are:

- Identifying information at the beginning of the form

- Part II, line 133 (self-funded plans complete the “Applicable self-insured plans” line; the “Specified health insurance policies” line will be completed by carriers for insured policies)

- Part III, items 3 and 10

- The signature section

- The voucher form, if the form is mailed

- The form may be filed electronically or mailed to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0009

Q12: Is the fee tax-deductible?

A12: Yes, the fee is tax-deductible.

Q13: Is there a penalty for failure to file or pay the PCORI fee?

A13: Although the PCORI statute and its regulations do not include a specific penalty for failure to report or pay the PCORI fee, the plan sponsor may be subject to penalties for failure to file a tax return because the PCORI fee is an excise tax. The plan sponsor should consult with its attorney on how to proceed with a late filing or late payment of the PCORI fee. The PCORI regulations note that the penalties related to late filing of Form 720 or late payment of the fee may be waived or abated if the plan sponsor has reasonable cause and the failure was not due to willful neglect.

Q14: How does a plan sponsor correct a previously filed Form 720?

A14: If a plan sponsor already filed Form 720, then the plan sponsor can make a correction to a previously filed Form 720 by using Form 720-X.

For more information, see:

- An IRS FAQ: Patient-Centered Outcomes Research Trust Fund Fee (IRC 4375, 4376 and 4377): Questions and Answers

- An IRS chart that shows which plans owe the fee: Application of the Patient-Centered Outcomes Research Trust Fund Fee to Common Types of Health Coverage or Arrangements

- IRS Form 720

- IRS Form 720 Instructions (see page 9)

- PCORI regulation: Fees for the Patient-Centered Outcomes Research Trust Fund

- An IRS Information Page: Patient-Centered Outcomes Research Institute Fee

Published 10/9/2017 Updated 7/9/2018, 11/5/2018, 12/20/2019, 6/8/2020, 7/23/2020, 12/1/2020, 3/18/22, 4/9/2023, 5/18/2024