The Patient-Centered Outcomes (PCORI) / Comparative Effectiveness Fee

The Patient-Centered Outcomes Research Institute (PCORI) fee initially applied from 2012 to 2019. However, in December 2019, the Further Consolidated Appropriations Act, 2020 extended the fee to 2029. The fee is due based on plan/policy years ending on or after October 1, 2012, and before October 1, 2029. The fee is due by July 31 of the year following the calendar year in which the plan/policy year ended.

The fee will be calculated and paid by the insurer for fully insured plans (although the fee is usually being passed on to the plan). The plan sponsor of self-funded plans (which is usually the employer) must file and pay the fee for those plans. (If the plan uses a third-party administrator, the TPA may assist with the calculation, but the plan sponsor must file the form.) Health reimbursement arrangements (HRAs) are considered self-funded plans, so employers will need to file for those plans, even if the insurer is filing for the related fully insured medical plan. If multiple employers participate in the plan, each must file separately unless the plan document designates one of them as the plan sponsor. MEC plans (sometimes referred to as “skinny plans”) are also considered self-funded plans, so employers will need to file for those plans.

The fee is based on covered lives, so employees, retirees and COBRA participants and their covered dependent spouses and children are all counted. However, only the employee, retiree or COBRA participant needs to be counted for an HRA – dependents covered by these accounts can be excluded.

Several options are available for calculating the fee:

- Actual count method – The plan counts its covered lives on each day of the plan year and averages the result.

- Snapshot method – The plan determines the number of covered lives on the same day (plus or minus three days) of each quarter or month and averages the result. (This method also allows the plan to count employees and retirees with self-only coverage separately from those with dependent coverage, and then multiply the count of employees and retirees who have dependent coverage by 2.35 to approximate the number of covered dependents, rather than actually counting them.)

- Form 5500 method – The plan determines the number of participants at the beginning and end of the plan year as reported on Form 5500. If dependents are covered, the plan adds the participant count for the start and the end of the plan year to get the total reportable lives. If dependents are not covered, the plan adds the participant count for the start and the end of the plan year and averages the result (this method cannot be used by insurers). Form 5500 must be filed by July 31 to use this option.

The same method must be used throughout a reporting year, but it may be changed from year to year.

The initial fee was $1.00 per covered life in the first year the fee was in effect. The Fee is adjusted each year for medical inflation. The plan sponsor must report and pay the fee on IRS Form 720 each July 31. This will be an annual filing, even though Form 720 is generally filed quarterly. The plan sponsor may file electronically or with paper.

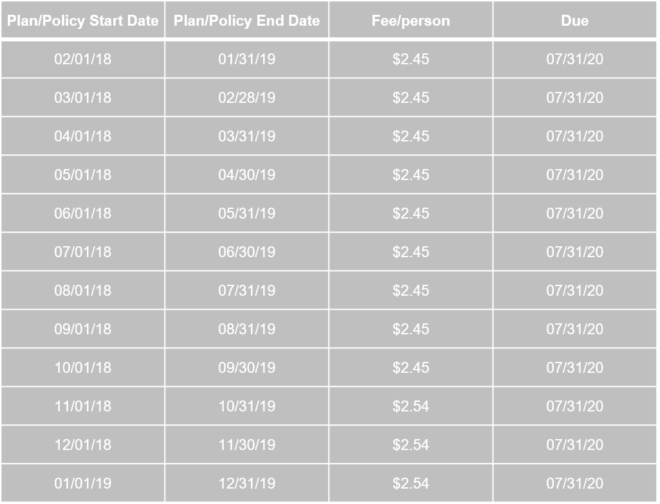

The following chart will help you determine what your applicable dollar amount will be:

The fees are due at the same time as the Form 720 is filed. The form and instructions can be found at: https://www.irs.gov/forms-pubs/form-720-quarterly-federal-excise-tax-return

If you need the fee schedule for any period prior to those listed above, please contact us at compliance@brinsonbenefits.com