Self Funding | 2019 UBA Health Plan Survey Trends

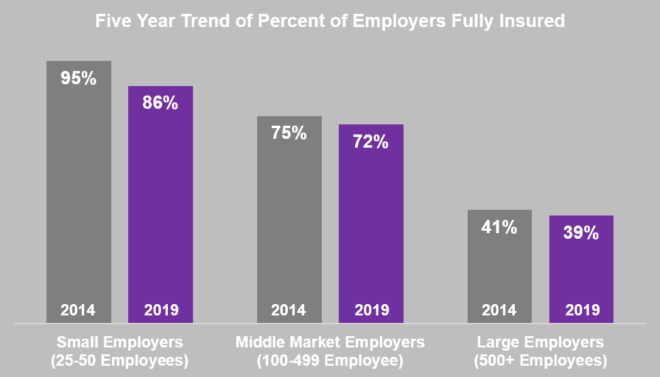

Historically, self-funding has been most attractive to the large group market, with approximately 60% of these groups choosing to self-fund, a number that has remained virtually flat over the last five years. Similarly, in the middle market (100-499 employees), approximately 30% of employers choose self-funding, which also has been fairly consistent over the last five years. The small employer market shows a different story. While only 5% of these employers chose self-funding five years ago, 15% of these groups chose to self-fund in 2019. This surprising year- over-year growth is a metric to watch and small groups should evaluate this option based on their industry, size, region, plan type, population risk, regulatory environment and other factors. UBA finds that, on a regional basis, there are areas of the country where self-funding is also on the rise, particularly for small and middle market groups, so it is critical to benchmark your plan regionally as well as nationally when evaluating this option.

Along with benefits for employers, self-funding models have an advantage for employees as well, namely lower deductibles. Among self-funded plans in the 2019 survey, the average in-network single deductible is $2,100 and the average in-network family deductible is $4,400, compared to $2,400 for singles and $5,000 for families in fully insured plans.